Decoding : Financing structure for the Sizewell C nuclear project, a risk-sharing model

By adopting the RAB (Regulated Asset Base) financing model for the Sizewell C nuclear power plant, the United Kingdom has succeeded in sharing construction risks among the State, investors, and consumers, while significantly reducing the cost of capital. Although this model cannot be directly applied to nuclear production activities in the European Union, its principle of risk mutualization should inspire France, which has yet to finalize the funding model for its first six EPR2 reactors.

On July 22, 2025, the UK Secretary of State for Energy, Ed Miliband, signed the Final Investment Decision (FID) for the construction of two EPR reactors at Sizewell C (SZC)[1]. The final financing structure differs from the one used for Hinkley Point C (HPC). It combines equity and debt, with both the UK government and private funds holding equity stakes. The project is governed under a different regulatory framework, the RAB (Regulated Asset Base) model. To recall, SZC is a replica of HPC. The total construction cost of these two EPR2 units is estimated at £38 billion (2024), or approximately €44.8 billion—20% lower than the cost of Hinkley Point C.

A mix of equity and debt, with both public and private investors

The financing structure of SZC builds on lessons learned from HPC. Unlike HPC, however, it reflects the intention to attract private capital into the project’s ownership. When HPC was launched, the UK government sought to rely exclusively on private investment, with no public financial contribution. NNB Genco, the project company that owns HPC, was entirely equity-funded, initially with a shareholding split of 66.5% for EDF Energy and 33.5% for China General Nuclear Power Group (CGN).

Since 2023, EDF has made additional voluntary equity contributions and held, as of June 2025, 74.9% of the capital (compared to 25.1% for CGN). In June 2025, EDF also announced an agreement with US fund Apollo to issue up to £4.5 billion in private-placement bonds to finance its UK investments.

At the time of the FID announcement, the government confirmed that it would take an initial 44.9% stake and invest £3.8 billion in equity in the project company NNB Generation Company (SZC) Ltd. The State is therefore the main shareholder and ensures governance alongside private investors.

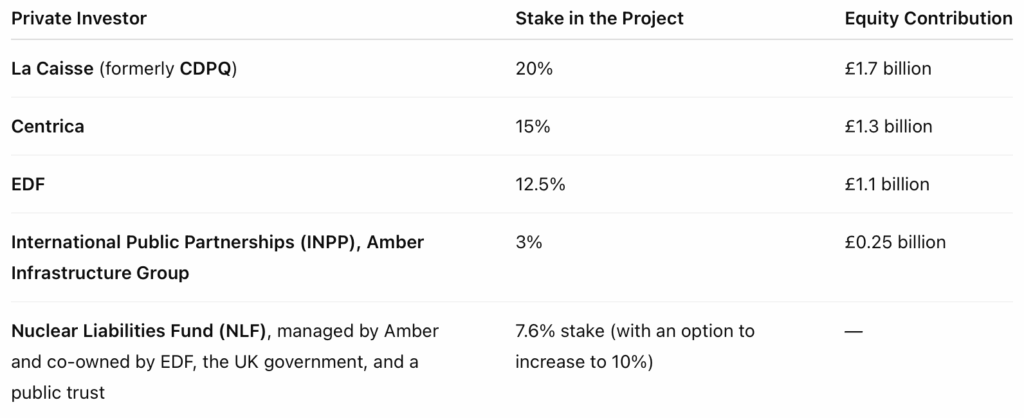

Other investors alongside the government include:

In addition to equity, the debt and public guarantees are structured as follows: the government acts as the primary lender through the National Wealth Fund (NWF), which may provide a term loan of up to £36.6 billion raised from financial markets. Meanwhile, Bpifrance Assurance Export provides a £5 billion loan guarantee to secure commercial bank financing. This financing package—combining £8.5 billion in equity and debt backed by public guarantees—provides an available financing capacity of around £50 billion. This amount, higher than the estimated project cost, is intended to cover potential cost overruns.

The Regulated Asset Base (RAB) Financing Model

The financial structure of Sizewell C will be based on the RAB model[2], which will be used for the first time to finance a nuclear project. The RAB model significantly reduces the weighted average cost of capital, estimated at 6.73%[3] for Sizewell C. This reduction translates into lower electricity bills and improves value for both consumers and taxpayers[4]. It also allows investors to receive dividends, with a capped rate of return of up to 6% during the construction phase[5]. In the event of cost overruns or delays, projected returns may be reduced, according to the government. After commissioning and during the operational phase, investors may achieve higher returns. Centrica anticipates a minimum overall return of 12%, while INPP estimates a return between 10% and 13%. For comparison, similar infrastructure projects generally deliver returns around 7–8%[6].

The RAB model is based on two key mechanisms:

- Stable revenue for shareholders starting from the beginning of the project.

A dedicated contribution is included in consumers’ electricity bills from the outset. Interest and dividends will be paid to investors and lenders during the construction phase. This reduces the total amount that needs to be financed and therefore reduces the size of the regulated asset base, because there is no need to raise additional loans to cover capitalised interest. It also lowers investment risk, as investors recover a significant portion of their capital during construction. The average additional cost to consumers during the construction of Sizewell C will be around £1 per month. Thanks to State participation, this contribution has been kept low. The government will issue sovereign bonds, which generally have lower interest rates. The resulting financial surplus will be passed back to consumers through lower RAB charges, and therefore lower electricity bills. In this way, the State “recycles” the benefit of low-cost financing. - Sharing of construction and operational risks between shareholders and consumers.

If construction costs exceed expected levels, a lower and upper threshold[7] are defined, and incentive-based cost-sharing mechanisms are applied, along with additional financing contributions.

| Mechanism for cost integration into the RAB | Total cost is less than or equal to £40.5bn (2024 prices) | Total cost is between £40.5bn and £47.7bn (2024 prices) | Total project cost exceeds £47.7bn (2024 prices) |

|---|---|---|---|

| Cost treatment in the RAB | – 100% of construction costs are added to the RAB – If final costs are lower than this threshold, 50% of the savings are added to the RAB | Only 50% of the additional costs are added to the RAB | Investors have no obligation to provide additional equity |

| Investor protection level | Investors are highly protected: everything is included in the RAB and they receive a high return | Investors share the risk: they do not recover all cost overruns, but part of the excess cost is covered | The risk no longer lies with investors but mainly with the State |

In addition to construction risks, the mechanism also covers certain High Impact, Low Probability risks that private investors could not or would not assume on their own, such as liquidity support to ensure cash availability in emergency situations (including debt repayment), and the possibility for the government to suspend the project under certain circumstances while compensating Sizewell C investors[8]. The government will also protect investors from catastrophic risks, such as nuclear accidents.

This mechanism responds to the conclusions of the 2017 UK National Audit Office report on the Contract for Difference (CfD) used for HPC. The CfD limits market risks but leaves most construction risk with industry stakeholders. This results in a high risk premium and therefore a cost of capital of around 9%. The final cost of electricity production (LCOE) is very sensitive to the weighted average cost of capital. The NAO warned that, even though consumers are protected from cost overruns, they could end up paying more for electricity from HPC than if the government had shared part of the construction risk. The RAB model provides a better balance between consumer and taxpayer interests and represents an advance in financial engineering.

What Lessons for France?

The RAB model is particularly relevant for capital-intensive nuclear projects, as it enables risk-sharing. By distributing construction risks, it helps reduce the cost of capital, and therefore the overall cost of the project.

Even if the British RAB model cannot be applied directly in other EU countries, it clearly demonstrates the principle of construction risk-sharing and confirms its impact in lowering the cost of capital. Within the EU, mechanisms such as PPAs and CfDs are more commonly used. However, construction risk-sharing remains essential to reduce financing costs.

A similar approach is already applied in France on the transmission and distribution networks operated by RTE and Enedis under the TURPE (tariff for the use of public electricity networks), which ensures regulated remuneration of assets in the regulated asset base.

During the French Nuclear Policy Council meeting on March 17, the government announced progress on the financing framework for the first six EPR2 reactors. It plans to offer a preferential-rate loan to cover at least half of construction costs and a CfD below €100/MWh. However, the government has not yet detailed how risks will be shared at each stage of the project. Following an agreement with EDF at the end of June, the State indicated that it would notify the scheme to the European Commission in the coming weeks.

In its report EDF’s Economic Model, the French Cour des comptes stressed that “the financing effort must be shared clearly and fairly between the State, now the sole shareholder, and EDF.” The Court considers that a clear, predefined allocation of risk-sharing responsibilities is essential both to maintain incentives for efficient project execution and to protect public finances.

Within the EU, the Dukovany project in the Czech Republic illustrates this risk-sharing approach. The government holds an 80% stake, supported by a subsidised State loan and a Contract for Difference. ČEZ, as private investor, commits to finance up to €1.95 billion in additional justified costs. Beyond that amount, the Czech State covers excess costs, subject to predefined limits[9]. This hybrid structure distributes financial and operational risks between the State and ČEZ, reducing exposure for each party[10].

You can find Sfen analyses of the Dukovany financing scheme, as well as those planned in Poland and Sweden. ■

By Floriane Jacq (Sfen), with Valérie Faudon (Executive Director, Sfen)

Image: Ed Miliband, UK Secretary of State for Energy Transition, at the IEA-UK Government Energy Security Summit, London, April 24, 2025.

[1] Sizewell C gets green light with final investment decision – GOV.UK

[2] Comment financer le renouvellement du parc nucléaire (version 2) – Sfen

[3] Electricity generation licence: special conditions for nuclear generator

[4] Regulated Asset Base (RAB) model for nuclear – GOV.UK

[5] How Britain enticed investors to back its costly new nuclear plant

[6] How Britain enticed investors to back its costly new nuclear plant

[7] centrica-2025-sizewell-c-presentation.pdf

[8] Sizewell C: government support package – GOV.UK

[9] Decision – EU – 2025/429 – EN – EUR-Lex

[10] Europe : financement innovant du nucléaire tchèque, une inspiration pour la France ? – Sfen