[Nuclear by the numbers] Nuclear fusion: $9.7 billion invested since 2021

With its series “Nuclear in Figures”, the Revue Générale Nucléaire examines sector trends through key data. Today, we focus on the 2025 reports released by the Fusion Industry Association (FIA). These studies confirm the rapid rise of a fast-accelerating industry.

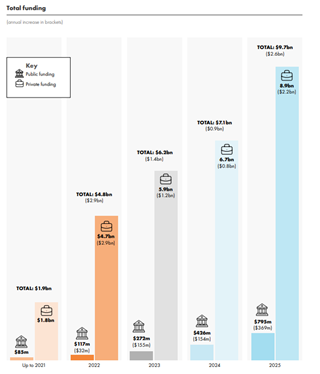

The reports The Global Fusion Industry in 2025 and The Fusion Industry Supply Chain 2025, published by the Fusion Industry Association (FIA), confirm that nuclear fusion has now entered a phase of accelerated industrialization. Since 2021, cumulative funding has surpassed $9.7 billion, including $2.6 billion raised in the last year alone. Meanwhile, spending in the supply chain reached $434 million in 2024 and is projected to exceed $543 million in 2025.

Growing public support

Public funding is now reinforcing this momentum: it increased by 84% in one year, reaching nearly $800 million (including $360 million added in 2024).

This growing support reflects both political and economic recognition of fusion’s potential: a technology-intensive industry, generating jobs and contributing to industrial sovereignty.

Over the past twelve months, Japan, Germany, China, the United Kingdom, the United States, South Korea, Canada and the European Union have all strengthened their national programs.

An expanding supply chain

The fusion supply chain is evolving in the same direction.

Expenditures, which nearly doubled between 2023 and 2024, are expected to grow by an additional 25% in 2025, rising from $434 million to $543 million. These amounts reflect the gradual industrialization of the sector and the consolidation of the infrastructure required to support future fusion reactor construction.

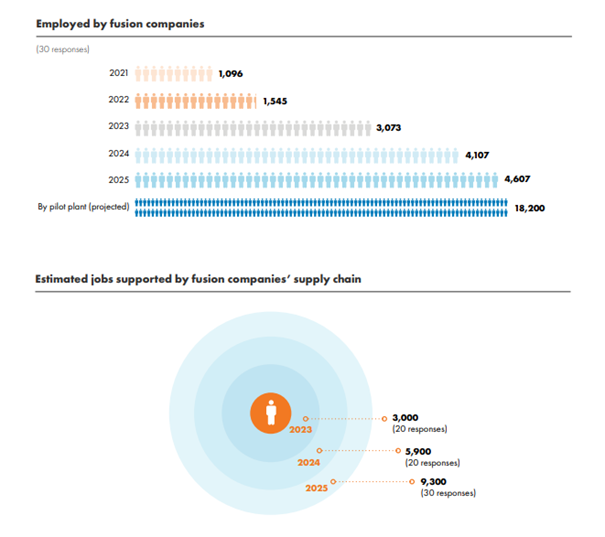

More companies, more jobs

The number of players is soaring: five years ago, the FIA identified 23 companies. In 2025, there are 53, employing more than 4,600 people — four times more than in 2021 — and generating more than 9,000 jobs across the associated supply chains.

Structural challenges remain

Despite this momentum, suppliers are hesitant to invest without clear visibility on demand, while fusion companies are waiting to cross key technical thresholds before making long-term commitments.

According to the FIA, 70% of the 50 suppliers surveyed consider fusion to be a moderate business risk, and only 30% report receiving clear guidance from their customers. However, the required scale-up remains moderate: manufacturing fusion components relies on smaller supply chains than those used in the solar or wind sectors, which could facilitate the transition to full-scale industrialization. ■