Decoding : What do the €60/MWh of existing nuclear power calculated by the CRE really represent?

The French Energy Regulatory Commission (Commission de régulation de l’énergie, CRE) published on 30 September, at the request of the government, a new estimate of the production cost of existing nuclear power. This assessment is intended to support the implementation of the new Universal Nuclear Contribution (Versement nucléaire universel, VNU) on 1 January 2026, introduced by Article 17 of the 2025 Finance Law (as the ARENH mechanism ends on 31 December 2025). The new estimate — €60.3 2026/MWh for the period 2026–2028 — differs methodologically from the one published by the CRE in 2023. On this occasion, the Commission released a comprehensive 160-page report providing detailed information on the cost structure of the French nuclear fleet.

A figure designed for a new framework: the Universal Nuclear Contribution

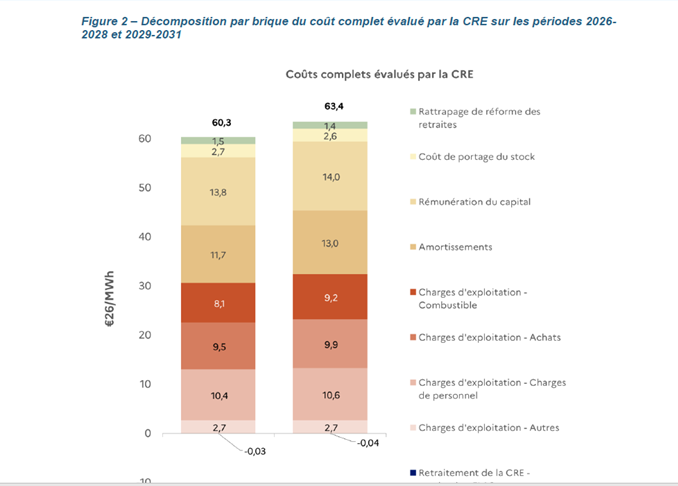

The CRE assessed the full production costs of the nuclear fleet over two consecutive three-year periods:

– €60.3 2026/MWh for 2026–2028

– €63.4 2026/MWh for 2029–2031

Developed in the wake of the 2022 energy market crisis, the Universal Nuclear Contribution (VNU) is intended to protect consumers in the event of sharp increases in wholesale prices. Beyond certain thresholds, part of EDF’s revenues will be collected — in the form of a levy on fuel — and redistributed to consumers, under a mechanism still to be defined.

These levies will follow a progressive threshold system: 50 % of the revenues generated by EDF’s historic nuclear fleet will be returned above the first threshold (the so-called taxation rate), and 90 % above a second threshold (the capping rate). The framework adopted by the CRE in 2023 was developed in a different context. At that time, the Commission had been asked by the government to work under the assumption of a regulatory scheme in which all nuclear production would benefit from a guaranteed selling price, through a symmetrical Contract for Difference (CfD) on a baseload volume — a mechanism proposed by the European Commission in its March 2023 electricity market reform.

Unlike most renewable sources, which benefit from guaranteed revenues, nuclear electricity prices are currently set — directly or indirectly — by the market. Following a gradual opening to competition, EDF has, since 2007, sold all its output on the market, whether through direct sales to customers (households, businesses, local authorities), wholesale market transactions (EPEX Spot, bilateral contracts, etc.), or, until the end of 2025, transfers to other suppliers under the ARENH mechanism (Regulated Access to Historic Nuclear Electricity).

Following the publication of its cost report, the CRE also released, as part of its VNU mandate, the methodology it will apply to calculate both observed and projected annual revenues from the nuclear fleet — an exercise it will have to carry out regularly. The first estimate of EDF’s revenues for 2026 amounts to €23.7 billion for a production of 360 TWh, i.e. €65.86/MWh.

The next key step in implementing the VNU will be to set the revenue-sharing thresholds. These thresholds, to be fixed by joint decree of the Ministers for Economy and Energy, will apply for three years.

– The taxation rate must fall between €5 and €25/MWh above the full production cost calculated by the CRE.

– The capping rate must fall between €35 and €55/MWh above those costs.

The State will therefore have to reconcile two potentially conflicting objectives: ensuring EDF’s ability to finance its future investments — including the construction of new reactors — while allowing French consumers to benefit from the competitiveness of the nuclear fleet. The Court of Auditors, in its September 2025 report The Economic Model of Électricité de France (EDF), warned about the scale of the group’s investment programme — estimated at €460 billion over 2025–2040 across all sectors — and recalled that electricity generation and retail in France remain its main sources of income. The Court stated that “the distribution of investment-financing costs between EDF, the State, and the group’s customers would benefit from greater clarity.”

A stricter accounting methodology and a clarified scope

The CRE’s exercise is framed by Decree No. 2025-910 of 5 September 2025, which defines the methodological principles for assessing production costs of the historic nuclear fleet. It is an accounting-based approach relying on actual company accounts, covering both operating expenses (staff, fuel, taxes and levies) and capital costs (depreciation of plant value and return on capital invested in the existing fleet). This approach also includes the updated costs of decommissioning, used-fuel reprocessing and waste management.

The 2025 estimate is lower than that of 2023, which was €60.7 2022/MWh, equivalent to €67.2 2026/MWh for 2026–2030. According to the report, the difference is mainly due to the exclusion of certain off-balance-sheet cost components that had been included in the 2023 method. The report also notes that EDF had suggested including interest accrued during construction for investments in the historic fleet and in the Flamanville-3 EPR, but these were ultimately excluded from the new methodology.

The CRE emphasises that the fleet’s projected output is a key parameter, since costs are expressed in €/MWh. A production variation of around 20 TWh (≈ 5 %) changes the full cost by roughly €3/MWh. The CRE assumes an average output of 362 TWh for 2026–2028 and 358 TWh for 2029–2031.

- The scope includes facilities whose initial operating licence was granted before 1 January 2026 — i.e. 57 reactor units. The Flamanville EPR is included, but the future EPR2 reactors are not. The CRE assumes a lifetime extension of the existing fleet to 60 years, subject to approval by the French Nuclear Safety Authority (ASN). This extension will need to be confirmed by the forthcoming Multi-Year Energy Programme (PPE).

- Regarding fleet availability, the CRE notes that the heavy schedule of planned outages related to the VD4-900 and the start of the VD4-1300 will continue to weigh on production over the period.

- On uprating projects: EDF told the CRE it plans to increase turbine output at two additional 900 MW units (Gravelines-1 in 2027 and Gravelines-3 in 2028). Nine 900 MW reactors have already been uprated, adding a total of 270 MW, equivalent to 1.6 TWh of extra annual theoretical output between 2026 and 2031. On the 1300 MW series, EDF is studying a possible increase in thermal power. EDF indicated that this project — intended to help reach the 400 TWhtarget and estimated to cost €1.4 billion 2024 — has been postponed “due to EDF’s financial constraints.”

The CRE acknowledges that under the new framework, EDF will be more exposed to market risk than under the CfD model considered in 2023. It therefore raised the Weighted Average Cost of Capital (WACC) assumption to 9.1 % before corporate tax, slightly below EDF’s proposal. This corresponds to a 50 % debt ratio, 5.1 % debt cost (based on EDF’s average adjusted coupon rate), and 14.0 % pre-tax cost of equity. The remuneration of equity consists of a risk-free rate plus a risk premium specific to the company’s activity and leverage. EDF’s exposure to electricity-market prices increases this risk premium. The higher WACC, reflecting greater market risk, could have raised overall costs — but this effect is offset by the exclusion of off-balance-sheet items.

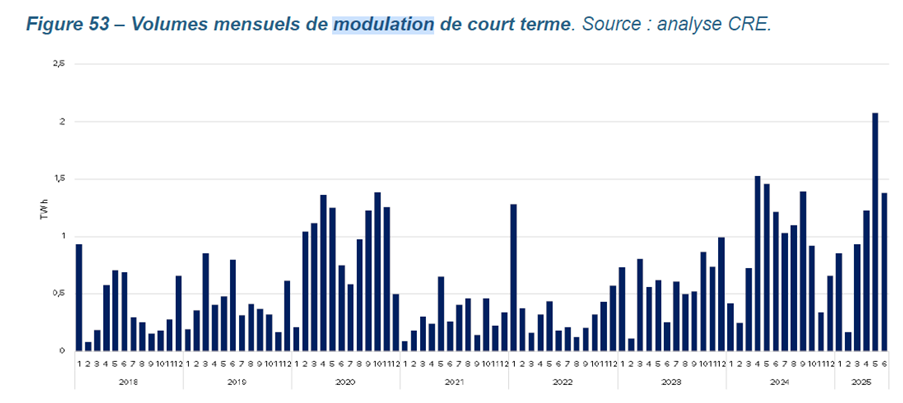

A marked increase in operational flexibility

The report pays special attention to the economic load-following of the nuclear fleet. The CRE recalls that EDF, like all generation operators, must reduce output from certain units when wholesale market prices (day-ahead or intraday) fall below variable costs — or even turn negative. EDF thus responds to market price signals, which serve as real-time indicators of supply-demand balance. The fleet’s load-following capacity — the combined flexibility of all operating reactors — varies between 15 % and 40 % of installed capacity, roughly 20 GW. Beyond that, EDF can shut down reactors, with a minimum downtime of 24 hours.

The CRE distinguishes two types of modulation:

-

Long-term modulation (≈ 40 % of total from 2019–2024), planned in advance to optimise fuel-stock management;

-

Short-term modulation (≈ 60 %), decided close to real time when wholesale prices fall below variable cost. EDF publishes daily data on the minimum achievable power for each reactor, hour by hour, for the next two days.

Excluding the exceptional year 2020 (marked by a sharp fall in demand), the CRE observes a clear shift in 2024 — confirmed in 2025 — towards a significant increase in short-term economic modulation.

In addition to nighttime reductions, daytime modulation has grown, particularly in the afternoon during periods of high solar output. The CRE notes that the number of hours when spot prices fell below €10/MWh — roughly the level of nuclear variable costs — rose to 16 % in 2024. The Commission identifies a strong correlation between modulation volumes and renewable penetration: “Renewable generation now appears to be a major driver of short-term modulation, alongside demand-level fluctuations for which the fleet’s flexibility was originally developed.”

Impact of fuel and personnel costs

Operating expenses (Opex) account for roughly half of total production costs and are analysed in detail. Key findings include:

-

Fuel costs of around €8/MWh, slightly increasing due to higher uranium, conversion, and enrichment prices amid a global nuclear revival. These also include long-term sustainability investments and Opex from Melox 1, as well as provisions for back-end-of-cycle management (recycling and waste disposal).

-

Staff costs of roughly €10/MWh, rising between 2022 and 2024 due to an increase of more than 2,000 employees. This reflects EDF’s expanded industrial programme and its decision to reinternalise certain strategic activities.

Investment expenses account for the other half of total costs, including:

-

Depreciation, estimated at €11.7 2026/MWh (of which €10.7 /MWh for the historic fleet and €1 /MWh for Flamanville EPR). Current accounting standards allow EDF to capitalise certain inspection and engineering activities as Capex. “Grand Carénage” Capex are depreciated over 10 years for ten-year inspections, and, for major replacements (generators, heavy components), over the remaining operating life of the unit.

-

Return on capital, based on the net book value (NBV) of the fleet: using the 9.1 % pre-tax WACC mentioned above, the CRE estimates average capital remuneration at €13.8 2026/MWh for 2026–2028 — split between €9.6 /MWh for the historic fleet excluding Flamanville 3 (€37 billion 2026 NBV) and €4.2 /MWh for the Flamanville EPR (€17 billion 2026 NBV).■

By Valérie Faudon, Secretary-General of the Sfen

Image: Chooz Nuclear Power Plant – © Shutterstock